The Myth of a “Quick Fix”: Why Legacy Insurers Can’t Just Add Palantir (or any other provider) and outpace Lemonade.

- IronicApe

- Jun 8, 2025

- 19 min read

TL;DR

Palantir <> magic fix. Foundry unifies data and powers AI, but it doesn’t replace an insurer’s slow, decades-old core systems or instantly create a slick customer app.

Legacy drag is real. Mainframes (COBOL), heavily customized vendor suites, and complex regulatory workflows make every new product, state, or rule change expensive and slow.

Data insight vs. process speed. Palantir can spot fraud or predict risk, yet claims still bottleneck if payouts rely on manual steps in legacy apps.

Lemonade’s edge. Built on one cloud-native platform with event-driven architecture and AI bots, letting it launch products faster and scale without linear headcount - so its expense ratio should keep falling as premiums grow.

Investor takeaway. Palantir is a powerful piece of the puzzle, but incumbents must modernise cores and processes in parallel; otherwise, they just add another costly layer while digital natives race ahead.

Introduction - In the insurance industry, technology can be a double-edged sword. Decades-old legacy systems underpin many large insurers, creating complexity and drag, while new digital-native insurers boast agile tech stacks built for speed. With the rise of platforms like Palantir (PLTR), some have wondered if legacy insurers could simply layer on a modern data platform and magically solve their woes.

The reality is far more complex. Palantir’s Foundry platform can indeed help unify data and apply AI across an insurer’s business, but it is not a silver bullet for deep-rooted technical challenges. This article will explore what Palantir can and cannot do for legacy insurance companies – from the front-end customer experience and risk/claims processes to the back-office core systems. We’ll also contrast the agility of a newcomer like Lemonade with incumbents and explain why a holistic transformation (not just one tool) is needed. Investors and stakeholders need to understand both the promise and limitations of applying new tech to old insurance problems. Let’s dive in.

Front-End Customer Experience: Modern Expectations vs. Legacy Reality - Today’s insurance customers expect seamless digital experiences – quick quotes, self-service policy changes, and instant claims updates on mobile apps. Insurtech startups like Lemonade ($LMND) built their customer experience from scratch with modern tech, allowing a renter’s policy to be bought in minutes via a chatbot, and some claims to be paid in seconds with AI. By contrast, many big insurers still rely on front-end systems that are tethered to multiple legacy back-ends, resulting in clunky user interfaces and inconsistent journeys.

For example, a customer might start a quote online but then must finish by phone or paper because different channels aren’t integrated. These disconnected systems lead to frustration and drop-offs when customers switch between apps, web, or agents. Legacy insurers often have duplicate applications for each channel or product – one system for agents, another for online quotes – which means the same product gets built multiple times, wasting effort and causing discrepancies.

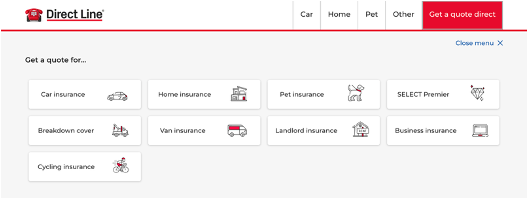

For example, consider Direct Line - undoubtedly a reputable company, but a useful example here. As one of the UK's largest insurance providers, the homepage neatly showcases their various lines of business. Yet even from the very first click, you encounter different brands, inconsistent user journeys, distinct URLs, and clearly separate technology stacks powering each product, sometimes involving third-party systems.

It's obvious even from the outside as some products aren't even available to purchase online, highlighting significant fragmentation within their digital infrastructure. I showcase the UK as typically the UK is a few years ahead of digital transformation than the US. Each screen below is just a single click from the originating page.

Palantir’s data platform could help improve front-end experiences indirectly. By aggregating customer data from various systems, it can give a unified view of the customer, enabling personalisation and quicker insights for agents or online portals. In theory, an insurer could use Palantir Foundry to power a single dashboard for customer info or to feed an AI recommendation engine on the website. However, Palantir is not a customer-facing web/app development tool – insurers would still need to build intuitive user interfaces and streamline workflows. If the underlying quote engine or policy administration is slow, simply layering Palantir won’t make an instant quote magically faster. It’s akin to attaching a modern navigation system to an old car – you might get better directions (data), but the car’s engine (core system) still determines how fast you can go. To truly fix front-end experience, insurers often must reengineer processes and modernise core systems behind the scenes, not just add a data analytics layer. In short, Palantir can enhance customer insight and decision-making, but it doesn’t automatically turn a clunky legacy front-end into a slick, user-friendly app.

Put simply:

It can’t change this… | Into this… |

|  |

Risk Analysis and Claims: Data vs. Process Automation - Insurance is a data-driven business at its core – from underwriting risk to processing claims. Here, a platform like Palantir does offer significant promise. Palantir Foundry can ingest and merge data from underwriting, policy, billing, and claims systems, allowing insurers to apply AI/ML models for risk selection, fraud detection, and claims triage.

For example, Palantir is being integrated at Sompo (a large insurer) to improve decision-making in pricing, underwriting, and risk management with AI-driven analytics. In claims, Palantir could help analyse images/documents or flag suspicious patterns by cross-

referencing multiple data sources – the kind of analysis legacy silos struggle to do. These capabilities can indeed speed up parts of the risk and claims process: imagine adjusters getting an AI-generated summary of likely fraud indicators, or underwriters instantly seeing aggregated data on a new customer’s risk profile from many systems.

However, data insights alone don’t resolve process bottlenecks. Large insurers’ claims

processes often involve multiple handoffs, legacy (or even modern) claims management software, and even manual steps (e.g. a human review for certain approvals). An AI platform might predict the outcome, but if the actual payout still requires someone to input into a green-screen terminal, the customer won’t get paid any faster.

True straight-through processing (as Lemonade performs with its AI Jim handling a third of claims end-to-end) requires tightly integrated systems and automation at the transactional level. Most incumbents can’t yet fully automate complex claims because their systems weren’t built for it. They may still require a claims adjuster to verify coverage in one system, a payment to be issued in another, etc., which slows things down.

Palantir can help augment human decision-making – for instance, by rapidly analysing a claim against historical data to suggest an appropriate reserve or flag an anomaly. It can also orchestrate some workflow by connecting systems (Foundry can write back to systems via APIs if configured). But it’s not a claims management system per se. Insurers would need to retrofit or replace their claims software to truly exploit Palantir’s recommendations in an automated way. The regulatory environment also plays a role: insurance is heavily regulated, and processes must adhere to compliance rules. Palantir might highlight that a claim in a new state requires a specific form, but someone still must implement that rule in the claims system.

In summary, Palantir brings powerful data analytics and AI that can supercharge risk assessment and fraud detection, but it can’t magically automate legacy processes. To fully realise faster claims or smarter underwriting, insurers must also modernise the process flows and core applications that Palantir plugs into, and often the “last mile of the journey” in this case, the customer getting their money is the most emotive and NPS impacting element.

Put simply:

It can’t change this… | Into this…. |

|  |

Legacy Core Systems: Mainframes, COBOL, and Vendor Platforms - The heart of the challenge lies in back-office core systems – the policy administration, billing, and claims systems where insurance transactions actually happen. Many large insurers are still running mainframe-based applications written in COBOL or similar languages from the 1970s-80s. These systems are robust and stable for high-volume processing, but they are incredibly inflexible and slow to change. Over decades, insurers have layered modifications on top of their core – one example is Columbia Insurance’s policy admin system, which after 20 years had 1 million lines of COBOL with 3,000 patches and still ran on a green-screen interface. Maintaining such a system is difficult; few young developers know COBOL, and those that do are retiring, making it a “real challenge” to find talent willing to work on it. It’s not uncommon for a big insurer to have tens of millions of lines of legacy code in production and hundreds of separate software modules, and while Ai coding will help with this, Hallucinations are real, memory is not optimal and not yet sufficient to rewrite legacy 30-year-old code without review.

Compounding the issue is the sheer number of systems. Through growth and mergers, an

insurer might operate multiple policy systems for different lines of business and regions – and these systems often don’t communicate well with each other. As an eye-opening example, GEICO (a major U.S. insurer) has around 600 legacy systems that don’t talk to each other. Data is siloed across these platforms, making enterprise reporting or unified customer service arduous. Integration layers and nightly batch processes shuffle data around in lieu of real-time connectivity. Even when insurers have adopted vendor solutions like Guidewire, Duck Creek, or SSP, those often exist alongside older systems.

Guidewire’s InsuranceSuite (PolicyCenter/ClaimCenter) is a popular modern core system,

but implementing it is a multi-year project (and VERY costly), and many insurers heavily customise it using Guidewire’s Gosu language (a variant of Java). Over-customisation can turn a “modern” platform into a new kind of legacy - upgrades become hard and the system can’t easily keep up with the vendor’s roadmap. In fact, even some so-called “modern” core platforms are monolithic and limited in ways that fall short of today’s needs.

They might run on updated tech stacks but still lack the agility for rapid changes or cloud scalability. I worked with a European Insurer that after four years were still trying to fully deploy their solution across their business, resulting in all nonlegal or regulatory projects to be placed on hold, what was effectively a complete stand still of their business innovation on the core business platform.

Large insurers also use a mix of third-party services – for example, external rating engines, document generation tools, or older vendor packages like SSP – each with its own technology stack and update cycle. Many of these are on-premises, require specific expertise, and were not built API-first, making integration and updates cumbersome. The result is a patchwork architecture where adding a new feature means touching multiple systems in sync.

When core systems lack modern APIs or real-time processing, workarounds like data warehouses or nightly batches are used, which delay improvements. As a 2025 an industry report noted, 74% of insurance companies still rely on outdated legacy tech for vital processes (pricing, underwriting, claims, etc.). These include systems with limited automation, proprietary code that’s hard to update, batch processing (instead of real-time), and databases that can’t support advanced analytics. Such systems slow down critical operations and limit an insurer’s ability to adapt, scale, and compete. In short, the core back-office of incumbents is often a spaghetti of old and newer tech, where any change is risky, time-consuming, and expensive.

Put simply:

It can’t change this… | Into this…. |

|  |

The Long “Road” to New Products and Markets - Given the above, consider what it takes for a large legacy insurer to launch a new line of business or enter a new state/country with different regulations. It’s a journey that can be painstakingly slow. First, the core policy administration system must be updated to handle the new product or jurisdiction. In a modern system, that might involve configuration – defining new coverage options, rates, forms, and business rules. In a legacy mainframe, it likely means writing new COBOL code or toggling ancient configuration tables, then testing to ensure it doesn’t break existing products.

If the insurer’s infrastructure is siloed, a new product might require updates in multiple systems: one for quotes, one for policy issuance, another for billing, and so on, each change coordinated carefully. It’s not just the software coding – there’s also regulatory compliance to embed (each state might have unique rules about coverage or pricing that must be reflected in the system). Without modern dev-ops practices, these code changes go through long dev and test cycles. Indeed, with legacy processes lacking continuous integration and automated testing, feature rollouts become lengthy and error-prone, making it hard for insurers to quickly adapt to new customer demands or regulatory changes.

Adding a new state or country often means dealing with new regulatory forms, tax calculations, reporting requirements – things that might not exist in the current system. For example, if entering California auto insurance, the system might need to handle specific coverage types or consumer notice forms mandated by California law. In a flexible system this could be a configuration update; in a rigid system it might require a code patch and a new print program for forms. Now multiply that by 50 states or multiple countries: legacy insurers usually roll out geography by geography with significant IT effort each time.

By contrast, Lemonade, which built one unified platform, can often add a new state by updating configurations in a single system and reusing the same codebase. Lemonade’s tech was designed to be multi-state, multi-line and multi-country from day one (I know of no other insurance company globally that can claim this), whereas incumbents might have separate systems per state (especially if they acquired regional companies over years). Lemonade’s leadership has emphasised that having a single unified tech platform is a key advantage that older competitors “will never be able to replicate,” given legacy firms’ stacks cobbled together via decades of M&A.

Even after coding and configuration, a legacy insurer must perform extensive testing (often manual) to ensure the new product works with all the interconnected pieces. There are also organisational hurdles: compliance teams, legal, underwriting, and IT all need to coordinate. Many large insurers use staged deployment – e.g. launch the product in one test state, iron out issues, then slowly expand – because doing a big bang launch nationwide would be too risky with their systems.

The result is that launching a new line or entering a new market can take many months or even years for traditional insurers. This slow pace isn’t for lack of smart people or desire; it’s an artifact of complex legacy tech and processes. Modernising to reduce this time-to-market is a critical goal for insurers. It’s noted that insurers “caught between rapid digital transformation demands and rigid legacy constraints” see impacts on key metrics like speed to market (and expense ratios). The expense of such undertakings is also non-trivial – every delay or inefficiency in launching products translates to cost and lost opportunity. Each new line of business is like a new road being built, with a unified technology stack, you can add them in weeks following regulatory approvals, instead of years. Legacy can’t compete if they can’t even launch the product.

Put simply:

It can’t change this… | Into this…. |

|  |

Lemonade’s Tech Advantage (and What Incumbents Can Learn) - Lemonade serves as a high-profile example of a digital-first insurer that, at least technologically, enjoys some structural advantages over legacy peers. Being founded in 2015, Lemonade built its systems with modern cloud architecture, microservices, and AI from the ground up. All its insurance lines (renters, homeowners, pet, Car, life) run on a single platform, giving a single source of truth for customer data and policy info. This avoids the fragmentation seen in older insurers. As noted earlier, GEICO has hundreds of systems that require complex integration, whereas Lemonade’s systems were integrated by design – “a single tech platform built from day 1”.

This means Lemonade can implement changes across the company more easily and avoid duplicated effort. For instance, if Lemonade updates its pricing algorithm or adds a user identity verification step, that change propagates through all products on the platform. A traditional insurer might have to implement a similar change separately in each line of business system and channel. Put simply, imagine if California suddenly required visual ID or KYC checks like Onfido, like banks. If they had a different platform for each line of business, they would need to potentially integrate four different platforms to Onfido to meet a single state regulation change, 4x the development, 4x the testing, 4x the time, 4x the cost.

Put simply:

It can’t change this… | Into this…. |

|  |

Lemonade also leverages A.I. in customer-facing roles – their bot “AI Maya” handles sales and onboarding, and “AI Jim” handles simple claims. By automating these interactions, Lemonade aims to operate with fewer human agents and adjusters, theoretically lowering personnel costs and speeding up service. In one case, Lemonade reported some claims paid in under 3 seconds via its algorithms (and we’ve seen times less than this shared in the community). Such statistics highlight what’s possible when your core processes are fully digital.

Expense ratio (the percentage of premium spent on overhead) is a key metric that could improve with these efficiencies. Traditional insurers often have high expense ratios partly due to legacy system maintenance costs and heavy staffing for manual processes. Lemonade’s bet is that an AI-driven, automated operation can eventually achieve a structurally lower expense ratio (though as a startup, Lemonade’s expense ratio has also been high due to growth and upfront costs). The point is that a modern tech stack lets you scale without scaling costs linearly – adding a million customers doesn’t mean adding thousands of extra staff if much of the process is software-driven.

That said, Lemonade is not a panacea either – it has faced challenges in underwriting accuracy and profitability presently (although we strongly believe these will resolve in the short to medium term as the ML models continue to improve coupled with the rapid acceleration of rate filing requests like the various ones we have seen this week), it operates in a highly competitive market. The incumbents have decades of experience, large balance sheets, and trusted brands.

But from a technology standpoint, Lemonade demonstrates the art of the possible: quick product launches, a pleasant customer app, AI-driven claims, and agile updates. Legacy insurers are indeed trying to emulate some of this. Many are investing in digital front-ends, partnering with AI firms, or even using Palantir Foundry to gain a unified data environment. The difference is that incumbents must do this on top of (or alongside) their legacy core, like renovating a house while people still live in it. Lemonade got to build the house anew.

For investors, the takeaway is that while new tech can give upstarts an edge, the large insurers have other strengths (scale, data volume, regulatory know-how) – the winners in coming years will be those who manage to blend the best of both: modern tech with the rich experience of legacy insurers. This likely means significant IT investment by incumbents and patience from investors, because deep transformation doesn’t happen overnight.

Palantir’s Role: A Powerful Data Layer, Not a Core Replacement - Let’s focus specifically on Palantir (PLTR) and why an insurer “can’t just add it” and assume problems are solved. What Palantir Foundry can do in insurance is quite impressive on the data side. It can integrate data from disparate legacy systems, creating a central layer where data is cleaned and linked. This can enable a 360° customer view, enterprise dashboards, and advanced analytics that were previously impossible due to siloed data.

Foundry also allows building analytical applications with relatively low-code approaches – for example, a claims triage app that pulls info from mainframe, CRM, and third-party datasets into one screen for a claim handler. Palantir’s platform has been used to develop AI models that evaluate physical documents and suggest pricing in underwriting, as seen in Sompo’s adoption to streamline complex processes. Another feature is the Foundry Container Engine (FCE), which Palantir touts can wrap legacy code in containers to run in a modern environment.

In other words, it lets institutions “leverage what’s working and safely leave behind what isn’t” from their legacy software. This can extend the life of reliable core logic by encapsulating it, while allowing new development around it.

Crucially, Palantir can sit on top of mainframes and vendor systems without replacing them – a fact that makes it attractive to executives who dread risky core system migrations. By operating as a data and orchestration layer, Palantir can deliver some quick wins: better reporting, AI insights, possibly automating workflows that span multiple old systems. It’s a bit like a high-tech “central brain” that can observe and direct parts of the organism.

However, what Palantir cannot do is erase the inherent complexity and technical debt of the underlying systems. If an insurer’s product definitions are hard-coded in COBOL, Palantir can’t change those rules; it can only consume their output or assist someone in changing them. If issuing a policy triggers ten downstream batch jobs on a mainframe, Palantir might help coordinate or monitor them, but the batch jobs still run as they always did. In essence, Palantir provides a unified interface and toolkit over fragmented systems, but the core transaction engines remain the same unless they are modernised or replaced. It is for this reason, even leading Insurance providers like Progressive PGR require 12,000 additional headcount to scale, where as Lemonade has reduced headcount by 2% while growing IFP roughly 2x the rate.

|  |

It’s important to recognise that Palantir is not a transaction system – it’s not going to actually hold your policies or process premiums (at least in current form). Insurers still need core policy admin systems for that. Some might envision Palantir as a stopgap to avoid a core replacement: instead of moving off the mainframe, just mirror all data to Palantir and build new features there. This can work up to a point (especially for data analytics or even digital twin-like use cases), but it can also introduce new failure points.

You might end up with yet another critical piece of architecture to maintain. There’s also a risk of vendor lock-in – if Palantir becomes deeply entrenched as the data backbone, the insurer may become dependent on Palantir (which, like any enterprise software, comes with significant licensing costs). Those costs will hit the insurer’s expense ratio, potentially offsetting some of the savings from efficiency. Palantir is known to be expensive, and while it can reduce other IT expenses (like consolidating data infrastructure), it’s not a charity.

Moreover, simply layering Palantir without simplifying the core environment can be like adding a turbocharger to a very old engine – you might get some speed boosts, but you’re also putting stress on an engine that isn’t meant for it. The smarter approach that many insurers take is to use Palantir (or similar tools) in conjunction with a modernisation roadmap. For example, they might modernise certain core modules to SaaS platforms (like moving a line of business to Guidewire Cloud) while using Palantir to connect the remaining legacy and new systems and to drive advanced analytics.

Over time, as legacy systems get phased out, Palantir’s role might shift more toward pure analytics rather than operational data plumbing. In any case, Palantir is a powerful enabler of digital transformation, not a substitute for it. It provides the connective tissue and brains, but the muscles and bones of the IT landscape (the core systems) still need exercise or replacement. Investors hearing about insurers partnering with Palantir should temper expectations: it’s a positive sign, but it doesn’t mean the company has instantly leaped to fintech-level agility.

Cost Implications and Conclusion - All these legacy challenges carry significant cost implications. Old systems can be costly to maintain – specialised hardware (mainframes), licenses for outdated software, and staff to keep them running contribute to operating expenses. There’s also an “opportunity cost”: inefficiencies in processes mean higher headcount in operations, longer cycle times, and possibly poorer customer retention. These all show up in an insurer’s expense ratio and profitability. Where as Ironic Ape predict a significant inflection point is quickly approaching for Lemaonde, where their top line grows faster than underlaying cost, rappidly improiving gross margins over time.

As noted, the industry is grappling with rising costs and legacy drag that hurt metrics like expense ratio and even market share. Introducing Palantir or any new platform comes with its own costs (software fees, implementation, training). If done right, the investment yields returns via efficiency gains – for instance, Sompo expects Palantir’s AI to deliver efficiency gains and improved response times for customers and partners. But if done wrong, it could just be an added layer of expense. Insurers must be careful to avoid creating a high-cost architecture that is “too complex to fail.” The goal should be to simplify and streamline in parallel with adding intelligent capabilities.

From an investor’s perspective, it’s important to understand that technology transformation in insurance is a journey, not a quick fix. Large insurers cannot flip a switch to become as nimble as Lemonade, but they also have resources and data that Lemonade is still acquiring. The competitive dynamic will likely favour those incumbents who can modernise effectively (through a combination of core upgrades, use of platforms like Palantir, and process re-engineering) while controlling costs.

It’s telling that many insurers pursue incremental modernisation - hollowing out legacy piece by piece – because doing a wholesale core system replacement is often too risky and expensive. In the interim, tools like Palantir can indeed add value by bridging gaps and accelerating analytics, much in the same was adding a database or web front end to the mainframe did. They just won’t resolve fundamental issues like a 30-year-old COBOL system that takes months to modify for new regulations.

For that, insurers either keep spending on maintenance or bite the bullet on modernisation, something highly unlikely due to the risk, cost and impact to EPS and short-term shareholder returns. The time to action these types of changes are typically longer than the average tenure of a CTO today (3+ years) meaning a 2nd CTO enters and immediately wants to put their stamp on things… and the original goal is never completed, perpetuating an endless cycle of change without meaningful delivery while disruptors continue to gain advantage.

Palantir is not a magical cure-all for legacy insurers’ tech woes. It’s a strong medicine for data problems – helping unify information, drive AI insights, and even stretch more life from old code – but the patient (legacy IT environment) still needs deeper treatment. A truly digital insurer of the future requires modern core systems, agile processes, and a culture willing to continuously adapt. Palantir can be part of that ecosystem, serving as the intelligence layer. But expecting Palantir alone to fix customer experience, compliance changes, or product launch speed is unrealistic. Those require addressing the “long tail” of legacy issues: outdated architectures, siloed org structures, and manual processes.

The insurance industry has started this evolution – cloud-based cores, API ecosystems, AI in underwriting – yet progress is gradual. Investors should look for concrete signs of improvement: faster product rollout times, lowering expense ratios, and better customer satisfaction. These are indicators that an insurer is successfully modernising. Palantir’s presence might facilitate those outcomes, but success ultimately rides on the insurer’s broader transformation strategy. In the end, technology like Palantir is a powerful tool within a larger toolbox.

The winners will be those who use all the tools effectively while rebuilding the toolbox itself for the digital age, frankly I’ve never seen any insurer like Lemonade, their culture, their technology, their strategy.

Summary - Why Lemonade’s Tech‑First Model Yields Long‑Term Speed and Cost Advantages

Lemonade illustrates what insurance looks like when built on a unified, cloud‑native platform:

Single Codebase, Multi‑Product, Multi‑Jurisdiction. Lemonade engineered one microservices architecture from day‑one, letting it add renters, pet, life, and auto insurance via configuration instead of parallel code streams. Expanding into a new U.S. state generally requires parameter updates, not major rewrites.

Event‑Driven, Real‑Time Processing. All policy and claims events publish to a single data bus; AI models act on those events instantly. That eliminates overnight batches, supports three‑second claims for straightforward losses, and dramatically shortens cycle time.

Automated, AI‑Centric Operations. Bots such as “AI Maya” (sales/onboarding) and “AI Jim” (claims) handle routine interactions, keeping human adjusters and underwriters for edge cases. This lowers variable labor cost and scales volume without linear headcount growth.

Cloud Economics and DevOps. Usage‑based cloud infrastructure plus continuous integration/continuous deployment (CI/CD) pipelines let Lemonade push dosens of releases per week, compared with quarterly release trains at some legacy carriers. Faster iteration accelerates product/market fit and lowers the cost of defects.

Data Flywheel and Owned Stack. Because Lemonade controls its whole stack, every customer touchpoint feeds back into proprietary data models, tightening underwriting and pricing over time. There is no dependency on third‑party cores, allowing full strategic control.

The Dividend on Up‑Front Investment - Lemonade’s early years were cap‑ex heavy: building a full insurance platform, securing multiple state licenses, and assembling an AI research team. Those costs show up in today’s expense ratio, but the marginal cost of future growth is falling fast.

Each additional policy rides the same automated infrastructure, and incremental product lines reuse shared services (identity, rating, payment, AI). As earned premium compounds, fixed platform and R&D expense spreads across a larger base, driving expense ratio downward. Crucially, Lemonade’s destiny is not tied to external vendors’ roadmaps or licensing fees, freeing management to deploy capital where it has the highest strategic return.

The Ironic Apes bottom line - Palantir Foundry can unlock tremendous value for legacy insurers by turning fragmented data into actionable intelligence. Yet it is neither a customer‑experience platform nor a core policy system. True digital transformation demands process re‑engineering, modern core platforms, and cultural change.

Incumbents who pair Palantir’s data unification with disciplined core modernisation stand to reclaim agility while leveraging their scale and brand. Meanwhile, digital natives like Lemonade demonstrate the structural advantages of a clean, cloud‑first architecture -reaping speed, operating leverage, and control that legacy carriers must work hard (and spend heavily) to match. For investors, the key is to differentiate between tools that enhance legacy operations and green‑field models built for a digital future from day one.

Disclaimer: Remember, we're just dumb apes -retail investors, not financial analysts. This is not financial advice; always do your own due diligence! The Ironic Ape remains long on LMND and currently holds positions in LMND. The Ironic Ape also holds positions in PLTR and remains long, despite it appearing very "expensive" right now based on its current multiples.

If you found this useful, you can find additional content at ironic-ape.com. For the latest updates, please follow @ironic_ape on X.